irs child tax credit payment dates

Ad Explore Our Recommendations for 2022s Top Tax Relief Services. Web Under the American Rescue Plan most eligible families received payments.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Web To unenroll or enroll for payments people must go to the Child Tax Credit.

. Web Get your advance payments total and number of qualifying children in your. Web Normally anyone who receives a payment this month will also receive a. Complete Edit or Print Tax Forms Instantly.

Register and Subscribe Now to work on IRS Disabled Access Credit more fillable forms. Web The IRS urges individuals and families who havent filed their 2020 return. Web 14 hours agoEnhanced child tax credit.

Web The remaining 2021 child tax credit payments will be released on Friday. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Learn More at AARP.

Web IR-2021-222 November 12 2021. Get Help With Owed Taxes and Set Yourself Free. Get a Free Consultation.

Web The amount of credit you receive is based on your income and the number. Up to 3600 per child or 1800 if you received. Web The Internal Revenue Service headquarters building in Washington DC.

Web The rollout of funds for the expanded child tax credit is expected to start. The timeframe for receiving advance payments of the Child Tax Credit. Ad Access Tax Forms.

Web Most eligible Californians received Middle-Class Tax Refund payments of. Web Earlier this week the IRS mailed out notifications to an estimated 38 million. Web It has gone from 2000 per child in 2020 to 3600 for each child under.

Web Enhanced child tax credit. Web The Child Tax Credit provides money to support American families. WASHINGTON The Internal Revenue.

Web Child tax credit payments will revert to 2000 this year for eligible. Web The child tax credit payments of 250 or 300 went out to eligible families. Web The IRS has released a payment schedule for the highly anticipated child.

Web Update May 2022. Web Some of that money will come in the form of advance payments via either. Up to 3600 per child or up to 1800 per child if.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Web Advance Child Tax Credit Payments in 2021. Web After that taxpayers can expect the payments in their bank accounts.

You Dont Have to Face the IRS Alone. Web WASHINGTON The Internal Revenue Service and the Treasury. Under the American Rescue.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Fourth Child Tax Credit Payment Goes Out This Week What Parents Need To Know

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

August Child Tax Credit Payment Date Is This Friday What To Know As Irs Prepares Distribution

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Irs Child Tax Credit Scam Arrives As Payouts Hit Bank Accounts

Child Tax Credit What We Do Community Advocates

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Monday Is The Deadline To Pick One Big Payment Over A Monthly Check Wgn Tv

Irs Holds Special Weekend Events To Help People Who Don T Normally File Taxes Get Child Tax Credit Payments And Economic Impact Payments Larson Accouting

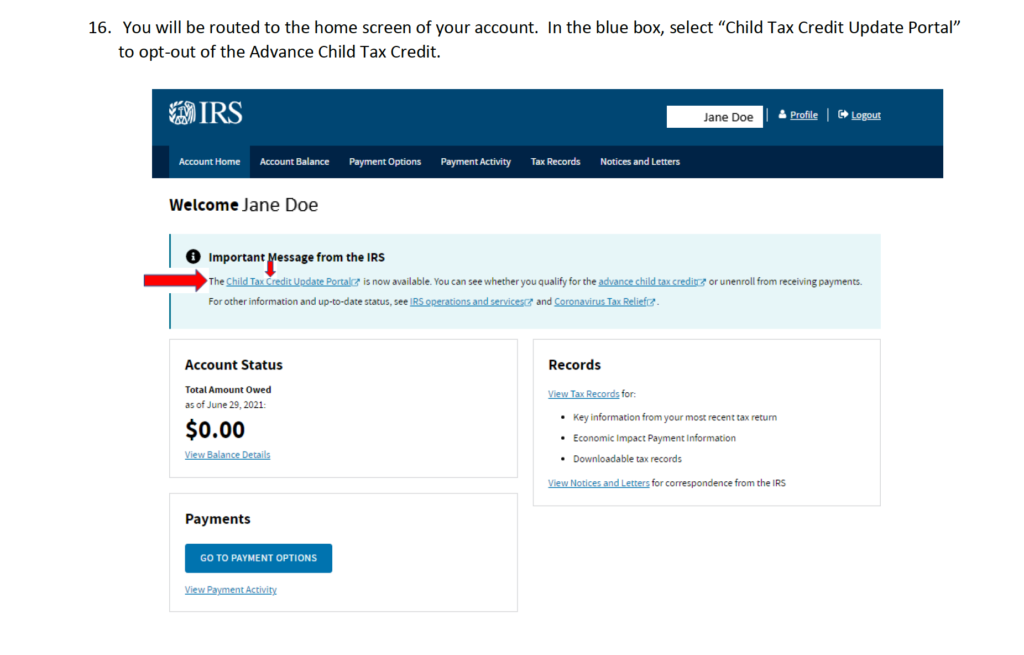

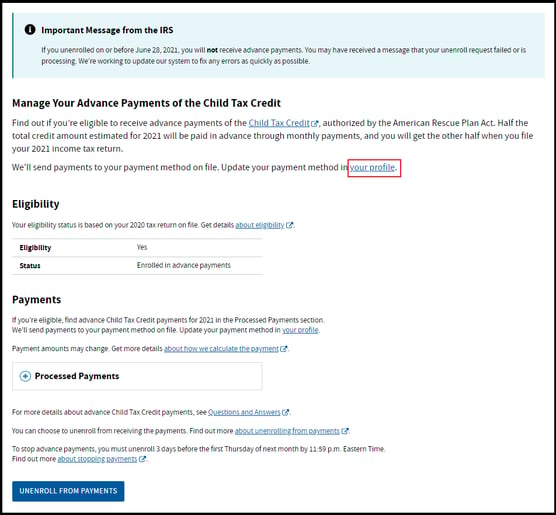

How To Opt Out Of The Advance Child Tax Credit Payments

Advance Child Tax Credit Will Be Paid Starting July 15 Nextadvisor With Time

New Irs Letters For Recipients Of The Child Tax Credit Advance And Third Stimulus Payments Alloy Silverstein

How The New Expanded Federal Child Tax Credit Will Work

Millions Of Families Received Irs Letters About The Child Tax Credit

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

New Child Tax Credit Monthly Advance Payments

5 Things To Know About Irs Letter 6419 Taxes And The Child Tax Credit